Gen Z and pensions: intentions competing with reality

19 Feb 2024

First seen on Money Marketing

First seen on Money Marketing

I am currently about 40% of the way through my journey to receive my state pension.

That is, if you started recording on the day I was born - in 1997. In more real terms, the UK government’s online State Pension Age Checker service informs me I’ll reach State Pension Age in April 2065 – meaning I have another 41.5 years to go!

Looking over 40 years into the future, it seems likely that the pensions landscape will look very different. By 2070, there are expected to be five million more pensioners in the UK, compared to just an additional one million UK residents of working age. As a result, The DWP’s State Pension Age Review projects that, by that point, State Pension-related expenditure will rise from 4.8% in 2021-22 to 8.1% of the UK’s Gross Domestic Product (GDP) by 2070-1. The World Economic Foundation has projected that average retirement ages in the UK may need to increase by an estimated 8.4 years by 2050 to maintain the current balance between working-age and non-working-age populations. That would make a possible state pension age of 75!

Given a near doubling of the burden of the State Pension as the population ages over the next 40 years, it seems likely that the Triple Lock system will be unaffordable. The current Triple Lock means that the state pension must increase each April in line with whichever of these three measures is highest:

- inflation, as measured by the Consumer Prices Index in the September of the previous year

- the average increase in wages across the UK

- or 2.5%

Gen Z and Retirement

Having been born in early 1997, I am almost as close to the ceiling of ‘Generation Z’ (using the most common definition of 1997-2012), as you are likely to find.

Having been born in early 1997, I am almost as close to the ceiling of ‘Generation Z’ (using the most common definition of 1997-2012), as you are likely to find.

It may seem odd discussing retirement in the context of Gen Z, as only a third of us have started working full-time to date: 4.3m of us are employed out of a total of 12.7m Gen Zers across the UK. Over the next 10 years, that percentage will swing upwards rapidly as more Gen Zers finish education and find work.

Pairing ‘Gen Z’ and ‘retirement’ in a search often leads you to articles which suggest that Gen Z are more optimistic than other generations when it comes to their retirement. Pension Bee found that only 5% of Gen Zers feel that they won’t be able to live comfortably in retirement, compared to 12% of Millennials and 16% of Generation Xers. This optimism is echoed in Canada Life’s recent Generation Gap Report, which finds that 18-34 year olds are more confident that they will be able to retire by age 60, than those aged 55 or over who on average, expect to retire beyond age 66.

This optimism could be caused by many factors: the feeling that anything is possible given the apparently yawning chasm of time to accumulate retirement savings, that youthful hopefulness that ‘anything is possible’, or perhaps more specific pensions developments like the introduction of auto-enrolment. Even if you take the optimistic retirement date of 60 as wished for above, I will still have well over 30 years to go. That is a considerable period in which to save for retirement, about five times that of my full-time working career to date.

Auto-Enrolment helps Gen Z start pensions saving early

The first tranche of Generation Zers would have been automatically enrolled into workplace pensions in 2019 once they reached age 22 provided they had reached the earnings threshold.

Consequently, much of Gen Z will begin saving for their retirement more or less as soon as they secure their first full-time job. This provides a stronger foundation from which to build as their career progresses and wages rise.

Increasing access to digital pensions engagement

There is no ignoring the vast wealth of information that is available via the internet, and my generation are probably online as much or more than most.

There is no ignoring the vast wealth of information that is available via the internet, and my generation are probably online as much or more than most.

Information regarding the various facets of pension saving can be researched through the websites and social media of various financial publications, news aggregators, financial advice firms & pension providers, providing Gen Z with an easily accessible wealth of information. This should help to create a greater awareness of the importance of saving for your pension as early as possible.

The way this information is presented will only evolve as time moves on, and Gen Zers will inevitably use, drive and/or create new and exciting pensions engagement applications using the latest FinTech innovations. Inevitably AI will change the landscape further, through robo-advice, projection tools and more.

There are plenty of reasons for Generation Z to be optimistic about retirement – so why does it not feel that simple?

The cost of living impacts Gen Z savings

The cost of living has impacted almost everybody in the UK.

The cost of essential items has increased dramatically. Food prices have increased by around 30% since October 2021, while gas and electricity prices are up by around 60% and 40% respectively over the same period.

Undeniably, many of Gen Z may feel protected from these costs due to living at their parents’ home. However, many UK Gen Zers will either have moved out or plan to move out, seeking greater independence or due to starting unversity or a new job.

These rising short-term costs make it all the more difficult to plan ahead for Gen Zers. In 2022, Ipsos MORI found that several of the issues that Gen Zers are concerned about revolve around the economy and finance. Over half of Gen Z are very concerned about inflation and the rising cost of living. This was closely followed by ‘becoming financially secure’ (40%), ‘being able to afford to buy my own property’ (34%) and being able to afford to rent somewhere to live (34%).

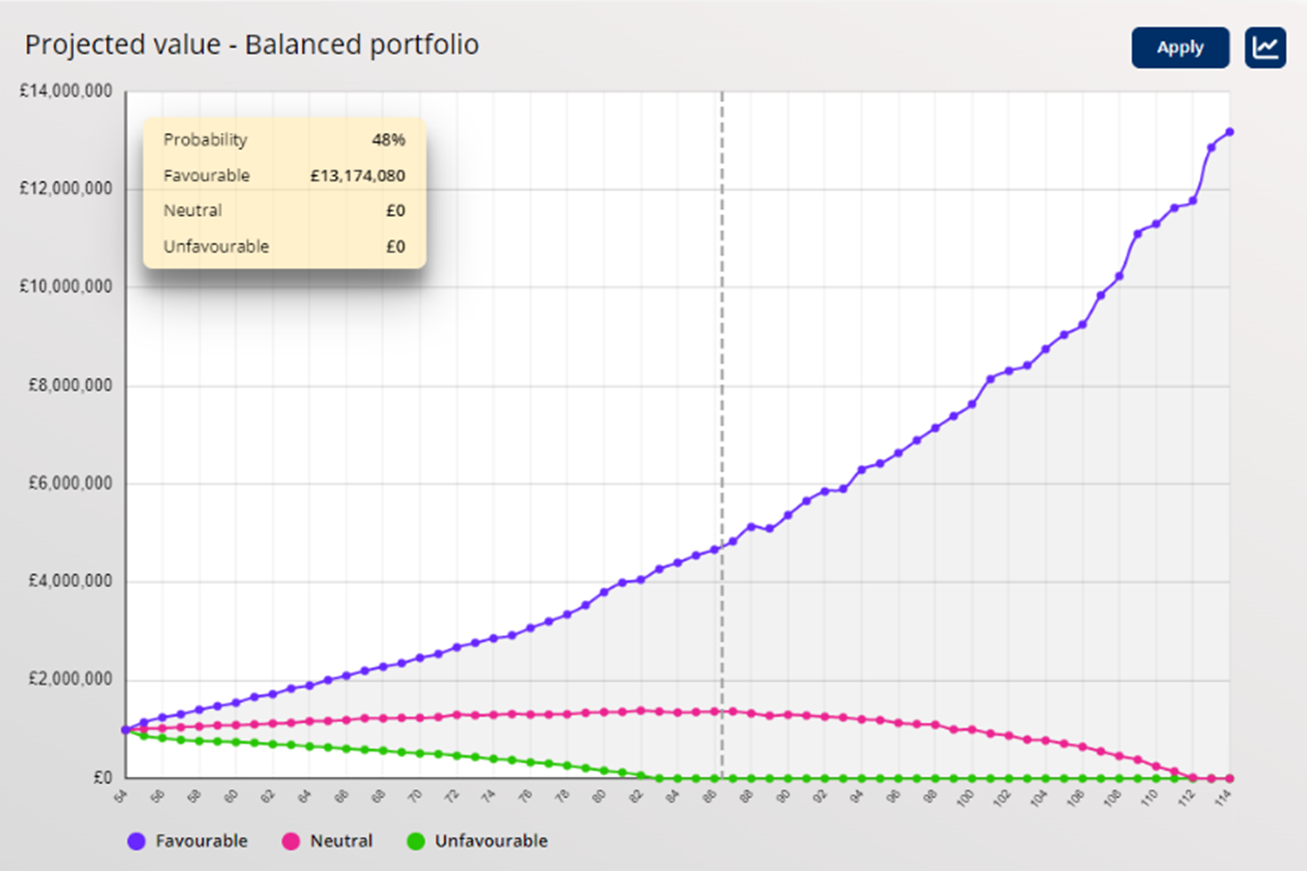

For many in Gen Z, these immediate problems lead to a blurred future financial plan, with doubt on which areas should take priority. According to Penfold, 17% of Gen Z savers have opted out of making pension contributions altogether, with 32% of that number doing specifically to save for a new home. This 17% will miss some of the most important years in their pension saving lives, as endless pension projections demonstrate that starting to save in your early to mid-twenties could help you to save nearly double that of someone who started in their mid-thirties.

This could perhaps be a draw towards seeking financial advice. Advisers could certainly help Gen Zers to navigate the long journey to invest wisely in order to save for a deposit on their first home, while continuing to maintain consistent pension savings to provide a strong foundation from which to build as salaries rise and their focus returns to saving for retirement.

Investing in real or fool’s gold?

There are, however, emerging signs that many in Gen Z consider advice to be only for older generations, perhaps leading them to turn to alternate, more informal sources of information, rather than the reliable sources discussed above.

Market researcher Savanta found that 40% of Gen Zers (aged 16-26) turn to social media for financial guidance. This could spell bad news as users could engage with unregulated, unverified and at times untrustworthy sources of ‘advice’. Recently, it was reported that UK pension savers have so far lost approximately £75 million to financial scams on social media - 593 of these victims were aged under 20!

The internet can be a gold mine for information, but the difficulty remains in attracting Gen Z to speak to regulated financial professionals, rather than get rich quick scammers and complaints management operations.

Gen Z - the freelance generation

Gen Zers have at times been referred to as the ‘freelance generation’, increasingly turning to self-employment or the gig economy for work, compared to previous generations. 36% of 16–25-year-olds in the UK want to start their own businesses, while 71% already work, or are planning to work, as freelancers.

However, pension saving amongst the self-employed is low compared to private sector employees, particularly since the introduction of auto-enrolment in 2012. Only 31% of self-employed workers are saving into a pension in the UK, according to IPSE. The nature of self-employment can affect pension saving levels, depending on whether it has been a 'good' or a 'bad' years, with people often deciding to keep the money back as a cash cushion in a tightening economy.

If Gen Z is to become self-employed in greater numbers than previously seen, this is a clear challenge to encourage savers to start early and maintain consistent pensions saving levels. Given Gen Zers’ preference for online research and the practical difficulties of advising the self-employed, there is a need for advisers to engage with self-employed Gen Zers online and via social channels. Recent social adverts targeting younger savers with messages about locating their old pension pots perhaps show the way in this regard.

Encouraging pensions engagement

I read Dunstan Thomas’ Generation X study of 2020, in which 40% of Generation Xers (now aged between 43 and 59) stated that they were not sure they would ever fully retire, while 22 per cent claimed to have no pension whatsoever! In Dunstan Thomas' 2022 Baby Boomer report, 71% of Boomers wanted to continue working (full or part-time) after they reached state pension age to supplement their retirement income. Reading these concerning figures have heightened my awareness regarding my own current pensions savings and financial future and have increased my resolve to contribute greater amounts wherever and whenever possible.

However, unfortunately, in the short term at least, this awareness and intention is defeated by rising bills, saving for a deposit, paying for food and drink, and making the most of my twenties. I still contribute to my pension, but I’m unfortunately paying in much less than I would desire.

But my eyes have been opened, and I have started up the steps to pensions engagement by reading the considerable amount of research and opinion pieces that demonstrate the importance of saving for retirement early, using financial advice and planning ahead. I am sure that a considerable portion of Gen Zers can be engaged through the same means as they reach the workforce, through social media and through workplaces which offer access to good quality regulated financial advice to steer them in the right direction.

Previous Article Contact Us

Alex Anderson

Marketing Executive at Dunstan Thomas

023 9282 2254

enquiries@dthomas.co.uk