The UK pensions system faces a time bomb that could detonate within a generation

30 Apr 2025

First seen in FTAdviser

First seen in FTAdviser

The UK faces a pensions time bomb that could detonate within a generation.

Unlike all good suspense movies, there is not going to be a cutting of the red or blue wire in the final seconds of a digital countdown; solutions are complex, multi-faceted and wide reaching.

For decades, the UK pension system has been regarded as a stable safety net, ensuring workers can retire with dignity. But beneath this illusion of security lies a crisis in the making. The combined pressures of demographic shifts, inadequate savings, and a state pension system under strain threaten to leave millions financially insecure in retirement.

Unsustainable burden on State Pension

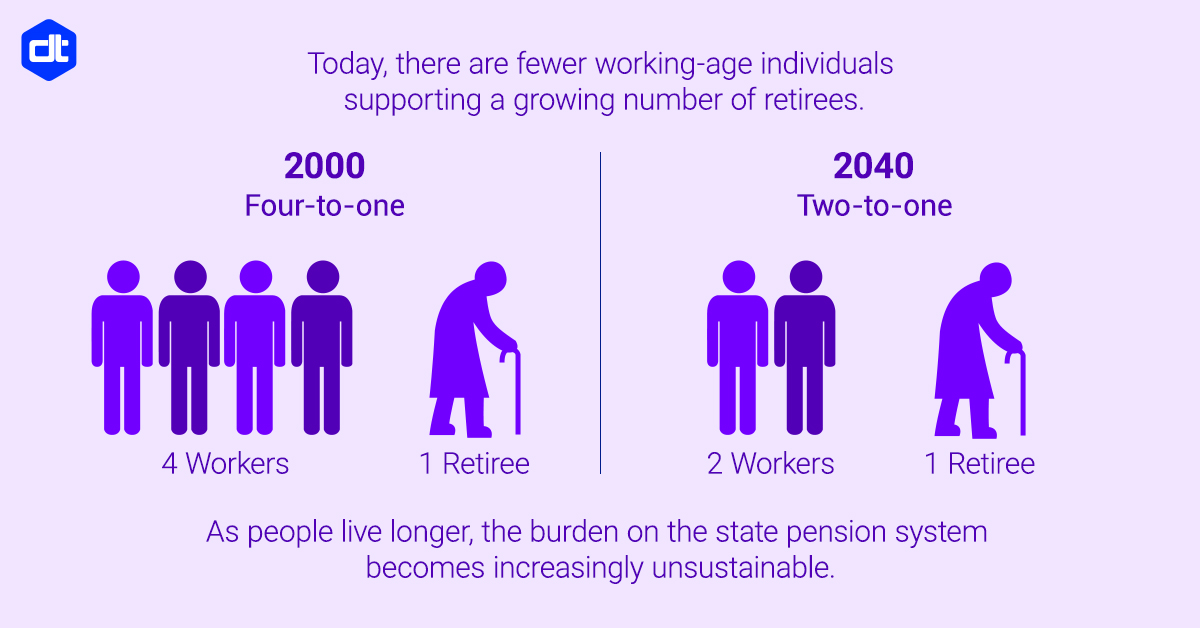

The UK’s population is ageing at an unprecedented rate. Today, there are fewer working-age individuals supporting a growing number of retirees. In 2000, there were approximately four workers for every retiree. By 2040, this ratio is expected to drop to just two to one. As people live longer, the burden on the state pension system becomes increasingly unsustainable.

The UK’s population is ageing at an unprecedented rate. Today, there are fewer working-age individuals supporting a growing number of retirees. In 2000, there were approximately four workers for every retiree. By 2040, this ratio is expected to drop to just two to one. As people live longer, the burden on the state pension system becomes increasingly unsustainable.

Meanwhile, the state pension age has not kept pace with these changes. While life expectancy has increased, the pension age has risen only incrementally. This imbalance means people are spending more years in retirement, drawing from a fund that fewer workers are contributing to, exacerbating the financial strain on the system.

Comparatively poor state pension

The UK state pension is among the least generous in the OECD, yet it remains one of the most politically sensitive benefits. The triple lock has become increasingly costly and maintaining it without a sustainable funding model places a growing burden on taxpayers.

There is also an intergenerational fairness issue. Younger workers are paying into a system that may not be able to support them in the future. As government debt rises and economic pressures mount, it is unclear whether future governments will be able to maintain current pension commitments.

The myth of pension auto-enrolment success

But private pension provision isn’t likely to come to the rescue for many future retirees as generally people are not saving anywhere near enough to be able to sit back and relax in their later years.

Auto-enrolment was introduced in 2012 to encourage workplace pension savings. While it has increased pension participation, it masks deeper issues:

- Low contributions: The minimum contribution of 8 per cent of salary (combined employer and employee contributions) falls short of the 12-15 per cent many experts recommend for a comfortable retirement.

- High opt-out rates: Many low-income earners, particularly in the gig economy, opt out due to financial pressures, leaving them with little to no retirement savings.

- Shift of risk to individuals: Defined benefit pensions, which guaranteed an income in retirement, have largely disappeared in the private sector, replaced by defined contribution (DC) schemes that expose workers to market volatility and uncertain returns.

Mitigating the UK pensions crisis

Without decisive action, the UK pension system risks collapse. Several bold measures could help mitigate the crisis:

- Mandatory higher contributions: Increasing minimum AE contributions to 12-15 per cent over time could help secure better retirement outcomes.

- Raising the state pension age further: Aligning the pension age with life expectancy would help balance the books.

- Reform or replace the triple lock: The triple lock was only ever meant to be a temporary fix. Moving to a sustainable, earnings-linked model could replace the costly guarantee while still ensuring pensioners do not fall into poverty.

- Universal basic income for retirees: Exploring a model of this nature could ensure that all retirees have a baseline income without complex entitlements and means-testing.

- Pot follows member: Helping to consolidate small pension pots and reduce administrative complexity.

- Pensions on the national curriculum: To equip young people with essential financial literacy so they can make informed decisions.

The UK’s pension system is at a tipping point. Ignoring the problem will only worsen the burden on future generations. Policymakers must summon the political courage to implement meaningful reforms, even if they prove unpopular in the short term.

There are many industry voices calling on government to depoliticise retirement planning and produce cross-party long-term plans that ensure smooth transitions when the party in power changes colour.

At the same time, individuals must be empowered to take greater control over their retirement planning. Better financial education, increased contributions, better engagement, comprehensive planning tools, and a realistic understanding of pension prospects are essential.

The UK pensions time bomb is ticking. Will we defuse it before it’s too late?

Andrew Martin

Chief Commercial Officer at Dunstan Thomas

023 9282 2254

enquiries@dthomas.co.uk